Travel Hacking 101: What Is Travel Hacking and How Is It Done?

People often say they can’t travel because of one of two reasons, time or money. While I am a big believer of the weekend warrior lifestyle and stretching every free moment to travel, we’re going to tackle the bigger issue at hand in our travel hacking 101 guide, money.

Many often assume that because of blogging every aspect of every trip is all-expenses paid. It’s most definitely not! What if I were to tell you there are thousands of people who are traveling luxuriously for nearly nothing that work normal 9-5 jobs?

Welcome to the mysterious world of travel hacking. There are many pseudonyms for utilizing credit card rewards for travel: credit card churning, travel hacking, award travel, etc. If you’ve traveled much, you might have heard other people talking about this ever-growing hobby, as is it is starting to become very popular.

I first stumbled into travel hacking a few years ago after our first trip to Japan in 2015. After we returned home, we discussed how we wanted to go back to Japan in a few years. Unfortunately, no matter how I ran the numbers, it appeared as if we weren’t going to be able to save enough money to make our dream trip happen. Just the flights alone with budget economy was going to be over $1,500 for the two of us.

Then I saw an ad for the Citi AAdvantage American Airlines credit card that offered a sign-up bonus of 60,000 miles. It made me think, “what if this could pay for our flights?” After a quick reward flight search, I found that if we both opened a card we could fly to Japan for practically free. (You knew there had to be a catch, this is highly variable and doesn’t always include additional costs like taxes and fees of course.)

This prospect obviously made me excited! I started to wonder if there were better cards or methods to cover more of our travel expenses and stretch these magical “points” to get the overall cost of our trip down.

The more I researched the more intimidating it was. It seemed like there was this “Illuminati” type of people who maximized these credit cards and appeared to travel posher than millionaires, all the while paying very little if anything at all. To be honest, it was a bit overwhelming and it seemed too good to be true. There had to be a catch, or a consequence I wasn’t aware of and it made me nervous to dive in.

Since that time I have joined Facebook groups, Reddit subs, read various blogs, and took courses to expand my knowledge on the travel hacking. Now I’m going to give you a quick guide to travel hacking 101 to learn about these credit card hacks that work!

FYI: Everyone’s financial situation varies greatly, I am not a CPA, attorney, or financial advisor in any form. Any advice or recommendation given is purely my opinion. You should always discuss your personal financial matters with your CPA.

What is Travel Hacking and How Is It Done?

Let’s start from the absolute beginning in this travel hacking 101 guide. Travel hacking is basically using credit card and/or loyalty program points or miles to redeem towards flights, hotels, cruises, etc. How these points are earned and what they’re worth we will discuss below.

Can I Use My Current Credit Card for Travel Hacking?

So maybe you have a credit card that earns “cashback” or “points” already. Can you use that to travel? The basic answer is, it depends. Before we get into the nitty-gritty of how you can use points/miles let’s discuss some of the differences between the hundreds of credit cards available. The simplest way to think about rewards is in two different categories: cash back and points or miles which we will cover in this travel hacking 101 guide.

Cash Back Credit Cards

First, let’s look at cash back credit cards. Most of these cards offer a flat rate at which you receive a percentage back of the money you charge on your card. The bare minimum your card should offer is 1% cash back, as most (if not all) cash back cards offer this benefit. Certain cards offer higher percent back on certain categories (groceries, gas, online shopping, etc.). While other cash back cards have the category change throughout the year. An example is the Discover It® Cashback, which has reward categories that change every quarter.

Cash back cards are simple to use and great for people who don’t want or need travel benefits provided by other cards. The way to redeem the cash back on these cards is typically by having your reward money taken off your statement, have the cash value mailed to you, or exchange the money for gift cards. The good news is, if this sounds appealing to you, a number of cards that use points or miles instead, still have the ability to be redeemed for cash back or gift cards.

Miles and Points with Airlines and Hotels

Points and miles get a bit confusing because they are often used interchangeably. The simplest way to think about points and miles is what company provides the points? Credit card companies will often partner up with airlines to provide credit cards that are co-branded.

These cards are offered by the major credit card companies but earn miles or points that are directly transferred to an airline or hotel reward program. These cards also often give you additional perks when using their products like priority boarding, free bags on flights, upgraded rooms at hotels, lounge access, etc. Most of these cards offer 1 point/mile per dollar on everyday purchases, with bonuses of more points per dollar when spending on their products (flights, hotel stays, etc.).

Let’s start with an example of Southwest Airlines® (SW). Southwest has a loyalty program called Rapid Rewards®. If you sign up for their loyalty program (even without a credit card) you get points for every flight you purchase. For example, if you purchase a Wanna Get Away fare ticket you get 6 Rapid Reward® points for every dollar you spend. You buy a $100 ticket, you get 600 points. Airline points are typically used to be redeemed for flights. So even without a credit card, if you fly Southwest enough as a loyalty member you can earn enough points to book a reward flight using your points.

Most major airlines have their own reward programs: American Airlines (AA) has AAdvantage®, United (UA) has MileagePlus®, Delta (DL) has Skymiles®, and etc. Some airlines give you miles or points based on how many miles you actually fly on their planes. For example, when I flew to Charlotte, North Carolina from St. Louis, Missouri I got miles for both my ticket and the 550 miles I flew from STL to CLT.

But, miles have benefits other than just being used for reward flights: frequent flyer status, companion passes, and other numerous perks exist but I won’t go into that in this post. (Stayed tuned for the next post in the series discussing perks such as companion pass.)

Another great benefit to airline miles is the ability to book on partner airlines. A good portion of the world’s airlines are in something called an airlines alliance. This is essentially an arrangement between different airline brands to be partners on flights. Examples of these alliances would be OneWorld, Star Alliance, and Skyteam.

These partnerships are awesome for award travel because they allow you to use your points to fly on partner airlines. For example, on our second trip to Japan, we collected American AAdvantage miles. Our inbound flight was from St. Louis, Missouri to Fukuoka, Japan.

Using our points, we flew American Airlines from STL to DFW, then Japan Airlines to Tokyo, and on to Fukuoka. These partner awards are great for international travel and allow a bit more flexibility with some of your airline points/miles. These types of flights are called codeshare and allow you to utilize many different airlines with your miles/points.

Miles or points earned by airlines are typically best used on the said airline (or partner airlines) and don’t have a lot of flexibility. Using SW as an example again, you can use points for reward flights, magazines, car rentals, hotels, and some merchandise. The issue is that using your airline miles or points for things other than flights typically doesn’t give you the best value (we will discuss the value of points later on in this post). Hotels have a similar setup to airlines, where you earn points by dollars spent or nights stayed in their properties.

Co-branded credit cards, such as the Southwest Airlines card or American Airlines card, are great for people who are looking for specific redemptions, are loyal to a particular airline/hotel chain, or want added benefits to their loyalty programs. For those involved in travel hacking, these types of cards become an integral part of your card arsenal.

Miles and Points from Credit Card Companies

While miles and points from specific airlines and hotels are very important, sometimes they don’t allow you the best flexibility. Let’s say you needed to fly from Dallas to Atlanta, you have enough United miles to book a flight but there is no availability or flights at the time you need. However, when you look at Southwest there is a flight that would work perfectly, but you don’t have Southwest miles. This is where credit card points/miles come into play.

Bank companies like Chase®, American Express®, Citi Bank®, Capital One®, etc. have credit cards that give you points or miles through their bank. These cards can have a lot of additional benefits and flexibility that you might not get with co-branded cards.

These cards often have good travel security benefits such as travel insurance, rental car coverage, no foreign transaction fees, and good reward categories. Another big perk they usually have is better points per dollar spent on travel and/or daily expenses (groceries, gas, etc.) than co-branded cards.

Let’s use Chase as our example, as they have a lot of popular travel cards for beginners to start with. One of their cards, the Chase Sapphire Preferred® (CSP) card is considered a luxury travel card. This card earns Chase Ultimate Reward® (UR) points.

These points can be used for a wide variety of redemptions including cash back, gift cards, flights, hotels, rental cars, cruises, and the list goes on and on. These reward redemptions are typically booked through the credit card website (called a portal, which we will discuss in further detail below) and are based on a point-to-money value (example: 1 point = 1 cent). This ability by itself makes it quite attractive because it allows you to book a variety of airlines, all with one card and type of points.

However, cards like the CSP have an added bonus, UR points can be transferred to partner programs! This is huge because it allows you to get even better value out of your points, and be able to combine points from multiple cards to allow you to achieve your travel goal.

An Example of Transferring Points

Let’s pretend you have 30,000 United Airlines (UA) points and 50,000 Chase UR points. You are booking flights from Chicago to Tampa on UA and need 35,000 UA Mileage plus points to book the flights through United. You check your Chase card and to book the flight with your UR points through Chase’s UR travel portal, it would cost 41,000 UR points.

Instead of using 41,000 of your UR points, you could transfer 5,000 UR points from your Chase card to your United account to have the 35,000 miles you need to book your flights for fewer points. The only downside to this is once you transfer points to an airline or hotel loyalty program you cannot transfer them back, and sometimes transferring points can take a few days.

Credit card points and miles are great for people who aren’t loyal to one airlines or hotel brand, or who want to get into the travel hacking game but don’t want to open numerous cards to use for their travels. Feeling confused yet? Not to worry, we will break all this down again and explain the process in more detail below.

READ MORE: Travel Apps You Should Download Right Now

How Do You Earn Points Quickly?

This is the biggest question in regards to travel hacking 101. By all means, you can open a card you think will be right for you, get your sign-up bonus, and use it for your day-to-day and that works fine. The problem is when some cards give you 1 or 2 points per dollar it can take a lot of purchases to get enough points to redeem for travel.

This issue is multiplied even further if you have a significant other, children, family, or friends you plan on traveling with. In this next section, I’ll discuss the process of credit card churning, where you open numerous cards to get sign-up bonuses to accelerate point earning.

But before I go any further, I do want to give you a word of caution in regards to travel hacking/churning. These points are great, and they do allow you to travel at great discounts to ease the financial burden of traveling. They are not, however, worth incurring ANY form of debt. Most award travel sites discourage those who cannot meet the following criteria or can follow these simple rules from even starting in the first place.

1. You need good standing credit to do this properly.

The exact FICO number varies depending on who you ask, but I say if your credit score isn’t above the mid to low 700s do not start churning. Opening and closing cards will cause your credit to fluctuate (I will discuss in detail below) and if your credit isn’t good to start with, you shouldn’t further burden it with travel hacking. Some credit cards you wouldn’t even be able to get unless you have good credit. Now Kallsy and I aren’t necessarily the standard rule for this, but just to give you an example our credit scores over the last three years have hovered between 780- 820 (even with churning cards).

2. You need to be paying off ALL your credit cards in full, EVERY statement.

It may sound great to leverage your credit to get to go on a trip for cheap, but this only works to your benefit if you’re paying off your card every month. The reason these companies have these incentives and bonuses is that they’re taking a calculated risk assuming most people will NOT pay off their cards, and the interest charged to those people will more than pay for the benefits given to others. I know most people don’t care much for math, but I will save you the trouble. In NO circumstance will paying interest on your card to be offset by the points/miles/perks you get from your travel card.

3. You need to be very, very organized.

Patience and organization are key to getting the biggest benefit out of travel hacking. You need to be able to sit down and see what your normal monthly expenses are, to see if you can hit minimum spending without excessive spending. Opening multiple cards can get confusing because you may have, multiple payment due dates, log-in credentials, sign-up bonus deadlines, annual fees, and other things you need to keep track of. Below is an example of the spreadsheet we use to track our credit cards and travel hacking.

| CARD NAME | DATE OPENED | BONUS | SPENDING | DATE BONUS EARNED | ANNUAL FEE | |

| EXAMPLE: | Chase Sapphire Preferred | 06/01/19 | 50,000 points | $4,000 on purchases within first 3 months | 08/25/19 | $95 – waived the first year |

4. Don’t buy more things just to get points.

If you normally spend $500 a month on expenses you could put on a card, but start spending $1000 a month to get points, it’s more than likely not going to play out in your favor. You could have just saved that $500 a month and used that for travel. And once again, if you start spending like crazy and get to the point you can’t afford to pay off your card, you lose by paying interest.

5. Don’t compare yourself to the Joneses.

Once you start joining groups and reading more about travel hacking you’re going to see people who seem to fly first class internationally every month and only stay at the Ritz. You have to keep in mind that travel hacking is VERY different from person to person. People who own their own businesses, travel for work, or even simply are seasoned experts at this, will have an advantage over beginners or those without those opportunities for additional points. Make your goals, set realistic expectations, and enjoy your victories no matter how big or small.

If you feel like you can’t follow the travel hacking 101 rules above, don’t lose hope. There are still ways to maximize your frugality when traveling. My first recommendation is to start with your day-to-day spending, get a budget, pay down debt, save emergency money, and rebuild your credit.

What to Know About Credit Card Churning

So you passed the test, and maybe while reading this you’ve done a quick Google search for reward flights from LA to Paris, but you see the economy ticket is 40,000 points round trip and first-class is over 100k! How in the world do you get that many points in a reasonable amount of time? As mentioned before, there are numerous ways to gain points by getting them on purchases you make on your cards, but the quickest way to get points is from sign-up bonuses.

Most travel credit cards offer a sign-up bonus to new customers to try and bring people in to use their cards. An example might be Chase Sapphire Preferred offering a sign-up bonus of 60,000 miles when you hit a minimum spend after opening the card. The simple thought behind this is to open a card, put all of your normal spending on it to hit the minimum spend for the bonus, then repeat with a new card.

If you feel a bit skeptical reading that, you’re not alone. This process of opening cards and getting bonuses is called churning. I’m going to answer some questions that I had when I first found out about this.

READ MORE: Save Time Traveling Using Global Entry

Does Travel Hacking Affect Your Credit Score?

Simple answer, yes. However, it is typically short-lived. This is why it’s important to have a good credit score before you consider doing this. I won’t get into all the factors that go into your credit score, but one of them is inquiries on your credit (hard credit pulls). Obviously, when you apply for a card they will want to check your credit, so this pull can decrease your credit score as it would for any credit inquiry.

I would say (anecdotally) Kallsy and I have had our scores drop anywhere from 20-40 points when applying for a new card. This typically corrected itself and returned to the original score within 2-3 months, as we always pay off all of our cards, every time. The good news is that when you open a card, your available credit increases which actually improves your credit score. The net effect is usually a temporary decrease, that (with no other negative factors) corrects itself in a few months (or at least it has for us in the 3 years we have been travel hacking with credit cards).

If you cancel cards that you open it can also decrease your score a similar 30-50 points, and will typically recover in 3-5 months. In regards to how this will affect your long-term credit, as long as you don’t cancel your oldest line of credit (the first credit card you’ve ever had), canceling the subsequent new cards shouldn’t affect the credit history portion of your credit score. We often downgrade our cards (i.e. product change) to cards that don’t have annual fees, because doing so won’t have a negative effect on your credit score.

What Exactly Is the “Minimum Spend” for Credit Card Sign-Up Bonuses?

So when cards offer a bonus for new cardholders, there is typically a minimum spend requirement to get the bonus points. An example tagline, “50,000 points when you spend $3,000 in your first three months of opening.” This merely means you need to have charged $3,000 dollars on your card within three months of the account opening in order to get the 50,000 points. The trick to this is being able to hit these minimum spends without spending more money than you normally do.

Let’s pretend your monthly expenses look like this (minus rent/mortgage): $200 home utilities, $150 gas, $300 groceries, $200 personal spending (gifts, clothes, entertainment, etc.), $100 eating out, $50 phone bill. If you’re able to put all those expenses on a credit card, that’s $1000 a month. If you were to get a card with $3,000 minimum spend in 3 months, all you would have to do is put all of your normal expenses on the card, then get the bonus.

Now there is a thing called manufactured spending where people who don’t have enough expenses are able to hit the minimum spend by other means. Typically this is done by prepaying bills, buying gift cards for expenses in the future, and numerous other methods. It is a bit more tricky to effectively do this if your monthly expenses are low, but with proper planning and consideration, it can be done.

Travel Hacking Using “Two-Player Mode” Will Give You More Points and Miles

For those of you who have a partner/spouse that is willing to get on board, travel hacking is even better in “two-player mode.” It eases the burden of constant credit pulls on one person, due to being able to alternate between people for card applications.

Another benefit is a number of cards offer referral bonuses, so when one person gets a card, they can refer “player 2” for the card and get bonus points/miles for when P2 signs up, I will give an example of this later in the cards I recommend. More people involved obviously gives you a lot more opportunities for points, but also requires more points to have two people traveling.

Don’t Credit Card Companies Get Mad About Travel Hacking? This Sounds Too Good to Be True.

First and foremost, they do know about it and have put some rules into play that do present some hurdles. The most talked-about rule you will hear is “Chase’s 5/24 rule.” This is a stipulation that Chase implemented a few years ago to limit the number of cards customers could open in a 24-month time span. This rule simply means if you have opened 5 or more personal credit cards (across all brands/banks) in the last two years (24 months) your card application will be declined.

This means that you need to be “under 5/24” to open a Chase card. This only applies to Chase branded cards, if you have 5 or more new cards in the last 24 months, you are still eligible to apply for cards from other issuers. People have also said that Chase keeps an eye on how quickly you are opening accounts. A simple rule of thumb (suggested by others) is to limit yourself to one new personal Chase card every 3-4 months to not draw unwanted attention.

If you have opened 5 cards in the last 24 months (you can check these dates by getting your credit report) you’ll have to wait until your oldest card is past the 24-month mark. After, you are once again eligible to apply for Chase cards.

Another thing to note is, you can actually get the bonus from a card more than once, but there are rules on that as well: you can’t currently have the card or have gotten the bonus in the last 24 months to get the bonus again. Simply put, you have to cancel or downgrade the card to get the bonus again, and wait 24 months from the date you got the bonus the first time.

Chase has a lot of very popular cards for travel and travel hacking, it is often recommended to start your travel hacking journey by looking at their cards to start, both due to their benefits and due to the 5/24 rule. This rule and other limitations with Chase are a hot topic of conversation in the award travel community and there are lots of loopholes, considerations, and fine print that I won’t discuss here.

American Express (Amex) has a rule that for some of their cards you can only get the bonus “once in a lifetime” as well as being limited to a total of any 5 Amex cards opened at one time. It’s often recommended to sign up for these cards when they have a high sign-up bonus offered due to this ‘one and done’ limitation.

Citi Bank doesn’t limit how many cards you can have, but rather how much credit across all cards they will extend to you. Chase has a similar rule to a limit of available credit, but this can be remedied by moving credit between cards or having credit limits decreased on cards you already have. Other credit card companies/banks have rules that are less stringent than those listed above, while these are still important, I won’t discuss them in detail here.

So as you can see, to maximize these benefits, it is crucial to have a strategy in place before you just start applying for random cards.

What About the Annual Fees?

An annual fee is obviously a charge the card company bills you so you can use their card. These fees can vary greatly between cards, depending on their benefits. This is another way the card companies try to recoup any losses from handing out bonus points and card benefits. The good news is a number of cards offer waived annual fees for the first year, or if they don’t, the sign-up bonuses typically often offset the fee significantly in your favor.

How To Avoid Paying Annual Fees on Credit Cards

One is to cancel your card, this, of course, will result in a negative impact on your credit score. In our experience canceling a card had a similar effect on our credit as applying for a card, 20-50 point drop, that corrected itself in 1-3 months. I don’t recommend canceling your oldest card, because your oldest line of credit does play an important role in your overall credit score.

Some people prefer to not close cards, but rather downgrade them to cards that have no annual fee. I did this with my Citi AAdvantage card, typically you need to wait until your annual fee has been charged to your account to downgrade your card (if the card is less than a year old).

Another technique is to call the card company and see if they can offer a retainer deal or retention bonus. I have called cards stating asking if they were offering a retention bonus or that I was considering closing my account and they either waved my annual fee or offered me miles/points to keep my account.

The last thing to keep in mind with annual fees is to only keep the cards you really get benefit/use out of. If you got a card for an airline you never use, for a one-time trip and sign-up bonus, don’t continue to pay the annual fee on the card. Instead, consider canceling or downgrading the card.

The more expensive cards often have additional features that the basic cards do not offer (like lounge access, airline/hotel credits, priority boarding, status upgrades, etc.) so keep that in mind when making your decision as well. Sometimes paying the annual fees are worth it for the perks of the card.

How Much Are Points Worth? How Do I Know If I’m Getting a Good Deal on Travel Rewards?

Simply put, if you get 1 point per dollar, and you are able to redeem $100 gift card with 10,000 points, your points are worth 1:1 (1 point = 1 penny). The goal of optimized travel hacking is to get better than 1:1, and typically try to avoid redeeming when you get less than one penny per point.

Reward programs changing the value of their points/miles and the availability of awards play a big role in how valuable your points are. There are a number of blogs and websites that have continually updating point “value” charts that give you an approximation of how much your points or miles are worth.

In regards to flying, saver award space is typically a discounted award ticket that provides huge value, so aiming for these type of tickets are optimal. These seats and tickets are usually limited and sell out quickly due to their discounted rate.

Standard awards are usually more expensive (more points required) but typically have better availability. The more flexibility and perks included in the ticket (free bags, seat selection, priority boarding, etc.) are typically associated with higher point costs. Searching early and always checking for changes is usually the name of the game for finding bargain award space.

Traveling during “peak” and “off-peak” times will influence your award availability as well. It’s usually more difficult to find award space around holidays or vacation times versus less popular seasons. When we are planning a trip I search when my desired airline starts releasing award space.

How Do I Start Travel Hacking?

In my opinion, the whole point of travel hacking is to go to places that you want to visit. Who cares if it’s a good deal unless you’re interested in going there. Make a list and ask yourself where you would like to go within the next year or two. If you don’t live near an airport, find out what airports are near you and what airlines fly to your desired destination.

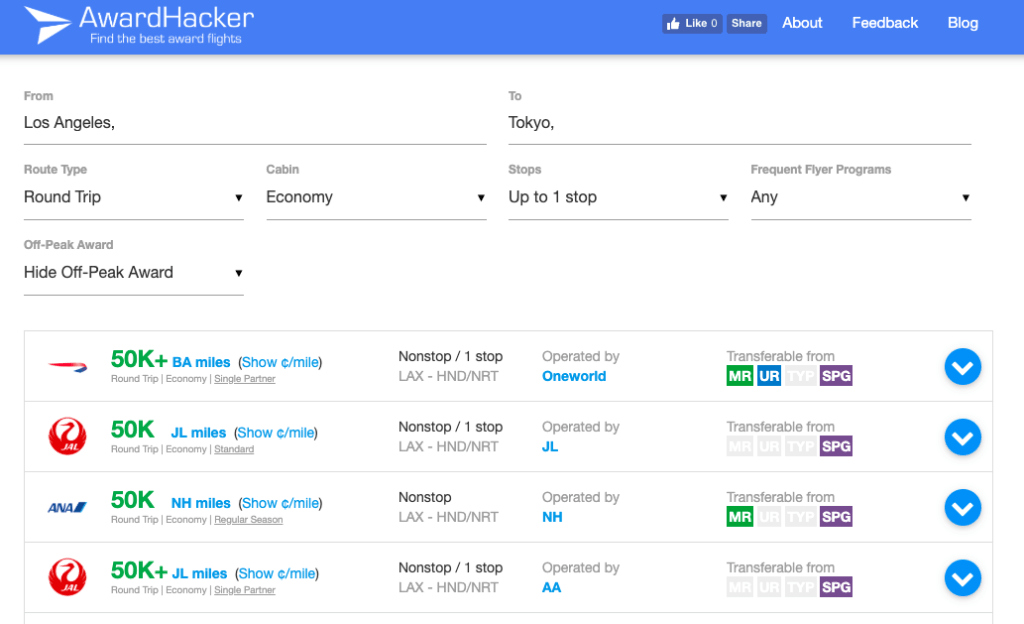

There is a website called AwardHacker that shows the theoretical award space between two airports. The points and airlines shown aren’t actual flights or guarantees but can help give you a ballpark idea of what airline or miles you need to be striving for.

Some other considerations to make are: Do you want to travel domestic or international? Multiple budget trips or one luxurious one? Chain hotels or Airbnb? These and other questions help pave the way for your travel hacking strategy. The more comfortable you get in the travel hacking game the more you will understand your preferences and goals. Kallsy and I like to be comfortable, but don’t mind downgrading in some areas to save points to possibly go on two trips versus a single luxury trip.

Find yourself an online group, forum (like Reddit), or website to start looking into the fine details of your strategy. Learning the lingo and searching more detailed credit card websites can help expand your understanding of award travel.

How We Used Points for Our 3-Month Trip to Japan

We had three years to plan for our Japan trip, and it was quite the undertaking to prepare ourselves to be as cost-efficient as possible. Even though it goes against the conventional award travel mantra, in 2015 we both got the Citi AAdvantage Platinum Select cards which offered a 50k sign-up bonus for each of us.

We picked AAdvantage because they seemingly had the lowest economy/business class saver awards to Japan from St. Louis, and we love the quality and comfort of flying Japan Airlines (JAL). That was pretty much all we did the first year and a half or so in regards to points.

I also signed up for an E-rewards survey account that was offered to me through an email from American Airlines. E-rewards is a marketing survey company that you can take surveys to get paid for, except I used my earnings for AAdvantage miles. Doing surveys ended up helping us get more points towards our goal of having economy one way, and business class the other. So far we’ve earned almost 7,500 extra airline miles by doing these surveys.

In regards to the airline miles, I ended up needing to buy miles to get enough to book our business class flights. Typically buying miles is not the best deal, because they cost more than they are worth. In our situation, we only needed a thousand more miles to upgrade to business class versus economy, and although not efficient, it allowed us to book the flights we wanted. Had we stuck with economy flights we would have had plenty of points but we wanted to live it up a little. 😉

Looking back, this was before I knew the depth of travel hacking and would have just opened business cards from American to make it easier and cheaper on ourselves versus buying some miles. Somewhere around the end of 2017, Kallsy opened a Chase Sapphire Reserve (50k bonus), and a few months later I opened up the Chase Sapphire Preferred (50k bonus). We used the Ultimate Reward points to book 22 hotel stays in Japan and an additional 8 stays later on through the Chase hotel portal (portal explained below).

The total points we used for this trip: 180,000 AAdvantage miles – two economy tickets at 30k per person one way and two business class tickets at 60k per person one way, as well as ~110,000 Ultimate Rewards points for 22 initial nights in hotels.

A Few More Examples of How We’ve Used Credit Card Points for Travel:

- 8 nights in hotels in Spain and Portugal (including taxes and fees).

- Round trip flights to fly between Spain and Portugal.

- Round trip flights to Maui, Hawaii using points, and Southwest Companion Pass.

- Round trip flights to Oakland, California using points and Southwest Companion Pass.

What Is the Chase Travel Portal?

Now that we explained the redemption above, you might be wondering what the Chase Travel Portal is. When you have a Chase card (particularly ones that utilize Ultimate Rewards (UR) points) you have the option of booking travel directly through Chase’s website (found once you log on to your credit account information), you click your Ultimate Rewards on your card portal (website) and it will take you to a page showing you all the options to redeem your UR points.

Obviously, we’ve talked about redeeming for cashback/gift cards/magazines (which you can do, but might not be the best utilization) but you then see a link to redeem for travel. Currently (as of 2019) the Chase travel portal uses Expedia as a search engine and allows you to book flights, hotels, rental cars, rental homes, cruises, and even some events/attractions!

This portal is where you can utilize the “bonus redemptions” you get with the CSR and CSP (50% bonus and 25% bonus respectively). For those of you who don’t care much for math a simple way to think of this is: normally 10,000 points would be worth $100 (1 point: 1 cent) but those same 10k points used through the portal are now worth $150 (with CSR) or $125 (with CSP) when you use the points for travel. It sounds great, doesn’t it? Well, it is!

Now, this is where your due diligence comes in when you’re looking at booking a hotel I recommend both looking at the portal and transferring points to get the best deal.

Here is an example (numbers are made up): Let’s say you want to stay at a Hyatt hotel that is $500 a night. You have the CSR and through the portal, you are able to book the hotel at roughly 33,000 points per night (33k points with the 50% bonus ~$500). You then go check Hyatt’s website and find that you can book the same room with Hyatt points for 25,000 points per night. So if you were to transfer your UR points to Hyatt and then book the room, you would save 8,000 points per night versus booking through the portal!

Other credit cards like Amex, Capital One, etc. also have similar type portals where you can book travel expenses directly. The UR Chase portal is nice because you can use the points to pay for taxes and fees (most of the time) for your booking as well.

We typically use the portal for boutique lodging or hotels where we can’t transfer points to their reward program. In Japan, there are quite a few Japanese hotel chains that we were able to book at a great rate through the portal which saved us a ton on lodging during our trip.

If you are looking at a hotel that you can transfer points directly to, definitely check to see whether transferring points or using the portal is cheaper!

What Credit Cards Do You Recommend to Start Travel Hacking?

The best travel hacking credit cards I recommend starting with are the Chase cards, typically the Chase Sapphire Reserve (CSR) and the Chase Sapphire Preferred (CSP) are the most popular cards due to their earning potential, transfer partners, and card benefits.

In my opinion, if you’re planning on really getting into the game and maximizing your point potential, I would lean towards the CSR. It gives you a $300 travel credit per year, earn 3x points on travel/dining, Priority Pass (airport lounge access to certain lounges/credits at some restaurants), reimbursement for Global Entry or TSA precheck, travel insurance, and numerous other benefits.

If you want to test the waters with something that doesn’t come with quite a hefty annual fee commitment as the CSR, consider the CSP. It has fewer ancillary benefits than the CSR but still has trip interruption insurance, no foreign transaction fees, and 2x back on travel/dining.

Once you get a good grasp on one of those, start looking into other cards in the Chase family that might help you towards your goals. Most other credit card/travel point websites you will see often encourage newbies to start with Chase products since you are limited to their 5/24 rule.

In another post I will discuss business cards, they will be essential to maximizing your points and earning potential. There are a few more rules and considerations you have to take into account with business travel cards versus personal cards, but it is quite easy to learn and can exponentially aid in earning more points.

Be sure if you’re playing “two-player mode” that you refer to your spouse/partner if you both are opening the same card. For example, you can get anywhere from 15K-20K UR points by referring a friend with the CSP card, if you refer your partner once they hit the minimum spend you both get a bonus!

If you are both in the same household another perk of some cards (like the Chase UR point cards) you can combine household points. One example is: Kallsy has the CSR and I have the CSP card, I am able to transfer my UR points to Kallsy’s card which is great when needing to use large sums of points.

READ MORE: The Best Credit Cards for Travel

I’m sure at this point your head is spinning from all the information and you probably have more questions than answers, but I hope this travel hacking 101 guide piqued your interest and gave you a solid enough foundation to know where to start. Travel hacking with credit card points is an ever-changing monster, but with proper planning and research, it is a great way to turn your everyday expenses into your next big adventure.

Any other questions about how to start travel hacking? Post them below! I will do my best to answer them or help in any way I can.